The US economy is long overdue for a recession. When that happens, companies are going to look for ways to trim fat– and that means they’re going to go after your tickets.

It’s been nearly 9 years since the last recession ended. Nine years of steady, if uneven, economic growth, reduced unemployment, and stock market gains. In his State of the Union address, President Donald Trump declared:

Small business confidence is at an all-time high. The stock market has smashed one record after another, gaining $8 trillion in value.

But how long can this streak last? Troubling warning signs lie on the periphery for those who can see them.

Expansions don’t last forever

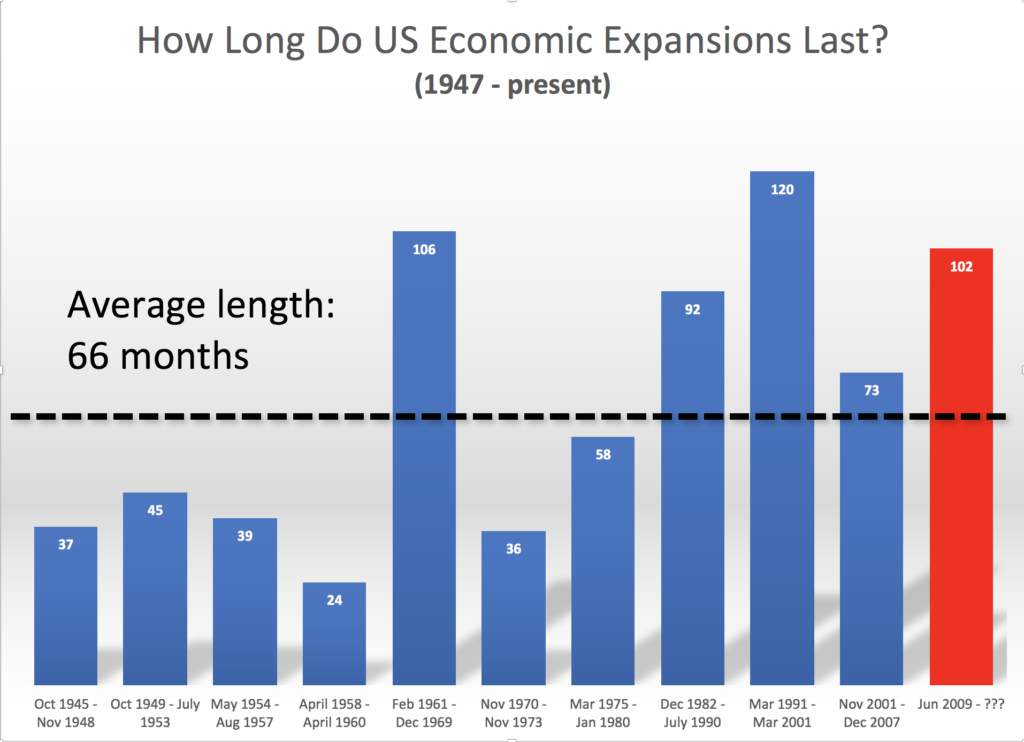

US economic expansions since 1947 tend to last an average of 66 months, or 5 1/2 years:

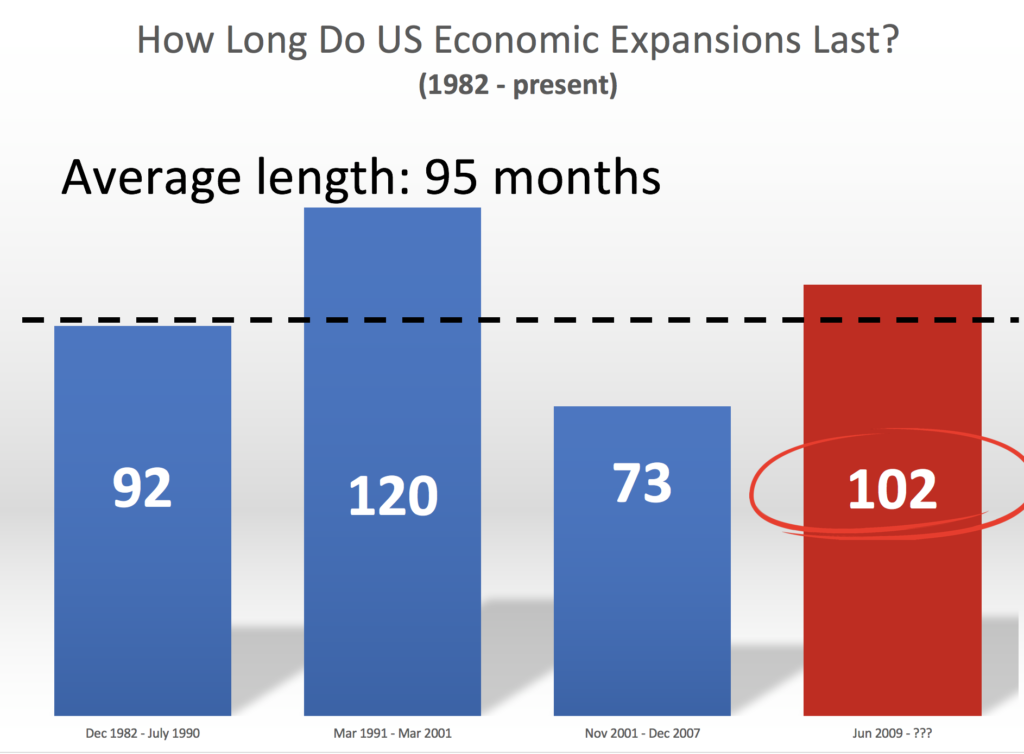

If you object to going back this far, you can limit your scope to the past 36 years:

No matter which dataset you consider, the current economic expansion is overdue for a correction.

But so far, we have only looked at broad historical trends.

Time to dig a little deeper.

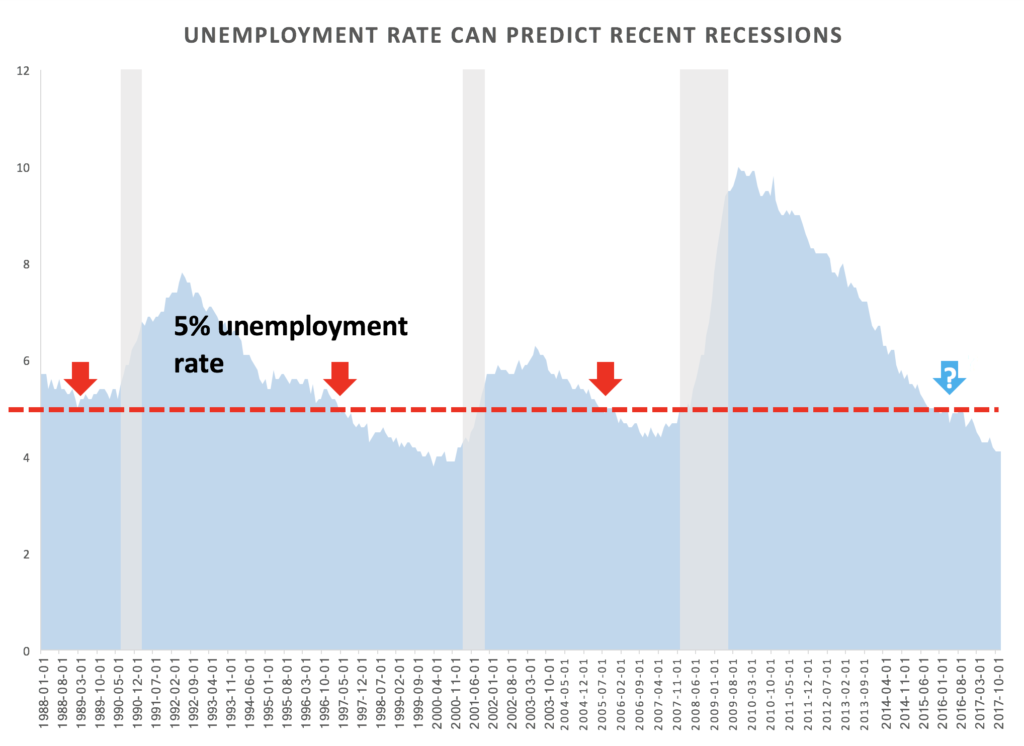

The unemployment trigger

One feature of economic expansions is an increase in hiring– or, conversely, a decrease in unemployment. But the labor market has a finite capacity to absorb additional job seekers. Each of the previous three recessions was preceded by unemployment touching down to 5% or lower:

Within 16 months of unemployment reaching 5%, the broader economy entered a recession. Unemployment reached 5% in September 2016– exactly 16 months ago as of this writing.

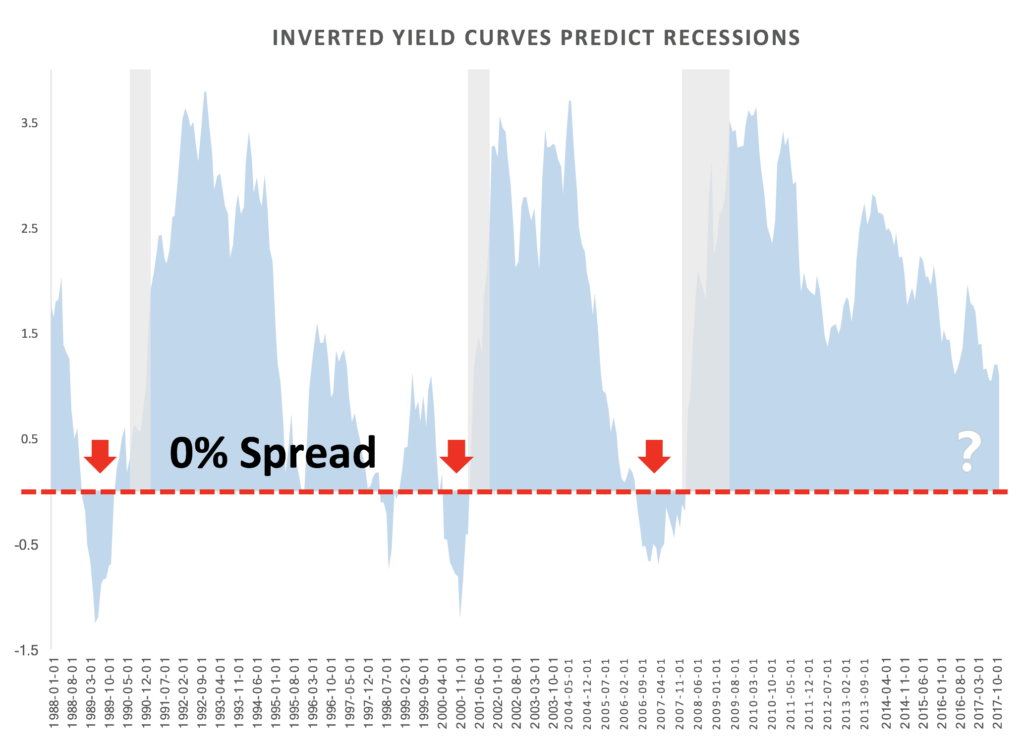

Inverted Yield Curve

A third factor which predicts recessions is the presence of an inverted yield curve. In a climate of economic uncertainty, investors become willing to park their money in short-term 10-year Treasurys– even when those Treasurys offer a lower yield than investments with a smaller time horizon.

Yield curves went negative prior to each of the previous three recessions:

The spread between 10-year Treasurys and shorter-term investments has been trending smaller since at least April 2014, and now stand around 1.4%. If this turns negative in the next several months, it’s a good predictor that a recession will follow.

Cuts, cuts, and more cuts

When faced with a recession, companies make cutbacks in several areas:

- Hiring freeze

- Travel restrictions

- Tightening of allowable reimbursements

- Training programs

And, too often– company tickets.

The reason is not hard to find: too many companies fail to prove the value of their investment in sports tickets. When the economic outlook is poor or uncertain, tickets often get put on the chopping block. During healthy economic times, companies may rest on the assumption their tickets are making a positive contribution to revenue. But in a downturn, this needs to be proven– or else those tickets go away.

How to protect your ticket program

If you wait until the recession arrives to justify your ticket spend, you’re too late– everyone is trying to defend their budgets at that point. You’re just adding to the clamor of those desperately trying to hold onto budget. Instead, prove the value of your company ticket spend by showing your leadership exactly how tickets are driving sales, upgrades, and renewals now.

By establishing the value of your tickets now, you get ahead of the curve and help make sports tickets the last thing your company wants to do in a downturn. (Why would you cut a program that has proven track record of driving revenue?) Winter may be coming, but that doesn’t mean the ticket program you’ve worked so hard to establish needs to fall victim to budget cuts.

By automating company tickets and providing managers with dozens of ROI reports, TicketManager has helped thousands of companies prove the value of their client entertainment.