WHAT DO COMPANIES DO WITH

$20 BILLION

IN SPORTS TICKETS

What are tickets really worth to a company?

According to the trash can, sports tickets aren’t worth much. Companies throw away more tickets than you will see in your

lifetime:

In fact, 43% of all tickets owned by businesses go unused. The average

business person uses only 7.8 tickets total tickets each year.

EVERYBODY KNOWS COMPANIES BUY

EXPENSIVE TICKETS.

HOW EXPENSIVE?

The average face value of a company ticket is $154.

The average face value of a company ticket is $154.  When companies buy tickets from the secondary market they pay $366 per ticket on average.

When companies buy tickets from the secondary market they pay $366 per ticket on average.  The average purchase on the secondary market (think StubHub) by a company is 4.7 tickets for a whopping $1,720.20

The average purchase on the secondary market (think StubHub) by a company is 4.7 tickets for a whopping $1,720.20

IF TICKETS ARE USED CORRECTLY,

THEY ARE WORTH EVERY PENNY.

When a business person invites a guest to a game, that guest

represents $161,544 in revenue for the company.

An average luxury suite at just one game costs a company $3,080 and hosts $2.58 million dollars in potential revenue.

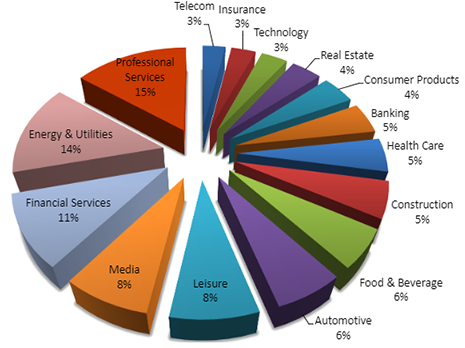

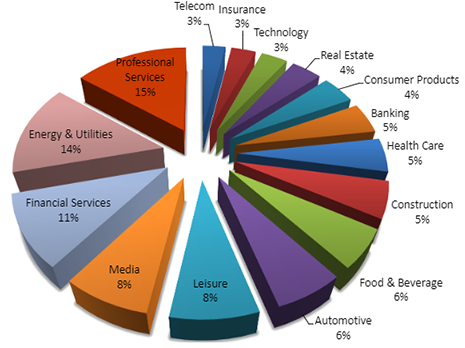

WHO DO COMPANIES GIVE TICKETS TO?

- Tickets as a boondoggle for corporate executives is a common misconception. In fact, over 75% of all tickets go directly to customers for business development and retention.

- The remainder of the tickets are used at the last minute as an employee perk or given to charity for a tax deduction.

- At some of the better performing companies, business development accounts for over 90% of use.

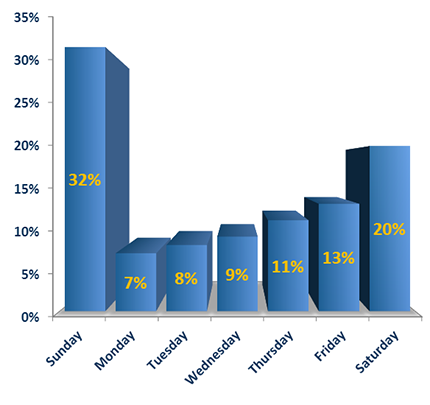

WORKING ON THE WEEKEND

- Most people think business gets done during the week.

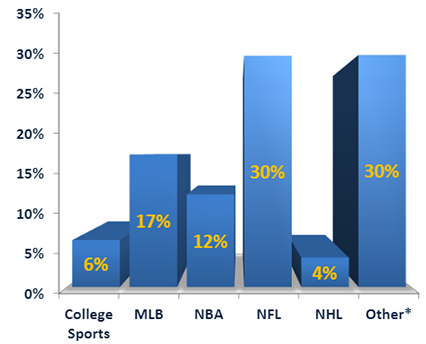

- Turns out over half of all ticket requests are for weekend games, driven by the popularity of the NFL.

- The demand for NFL tickets is 4x that of any other league due to the shorter schedule, the limited amount of home games, and the

popularity of the league with the corporate set.

BANKERS HAVE THE MOST TEAM SPIRIT

*Ticket ownership by industry represents the number of tickets owned by each industry as classified by Dun & Bradstreet. Each firm is represented in their Dun & Bradstreet industry in the study with over 1000 firms used to compile data.

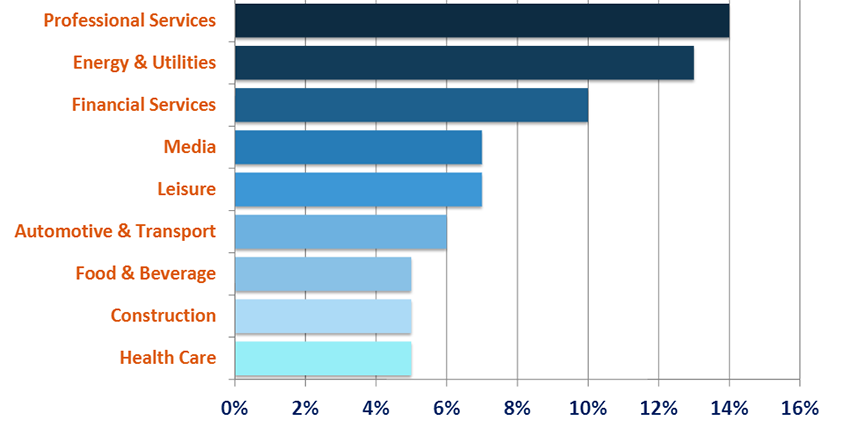

WHAT DO BANKERS, LAWYERS, & OIL

MAGNATES HAVE IN COMMON?

There’s a good chance the person you see up in the suite works in finance.

- Over half of all sports tickets are owned by only

5 industries: - 1.PROFESSIONAL SERVICES

2.ENERGY AND UTILITIES

3.FINANCIAL SERVICES

4.MEDIA

5.LEISURE

*Ticket ownership by industry represents the number of tickets owned by each industry as classified by Dun & Bradstreet. Each firm is represented in their Dun & Bradstreet industry in the study with over 1000 firms used to compile data.

WORKING ON THE WEEKEND

- The NFL is far and away the most popular league for corporate entertainment today with over 5 people asking for each ticket. The next closest: the NBA with 1.4 people asking per ticket.

- How is demand measured?

By how many staffers ask to use a ticket. Hot events will sometimes garner up to 50 requests for a single set of tickets.

*Other includes Golf, Concerts, Broadway Shows, and other live events purchased regularly by businesses

IF YOU HAVEN’T GOTTEN THAT INVITE YET…

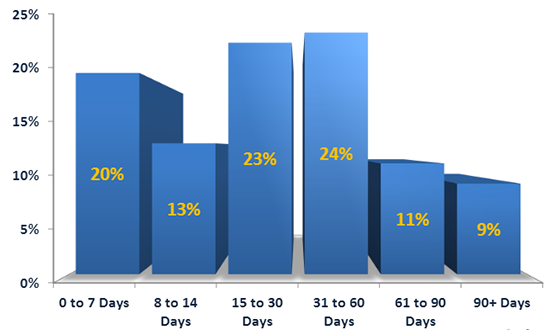

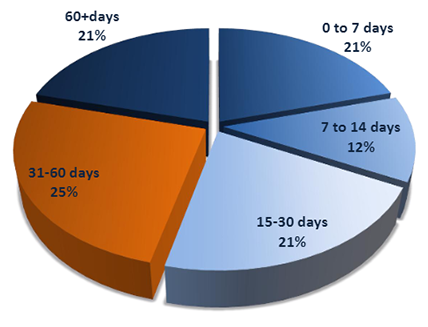

- Most believe tickets are a last minute item. That is not the case for businesses. In fact, most companies know who is going to the game more than a month in advance.

*Other includes Golf, Concerts, Broadway Shows, and other live events purchased regularly by businesses

HOW FAR IN ADVANCE DO COMPANIES

BUY TICKETS?

- Further out than you’d think. We’ve

all seen long lines at the box office but companies, in general, buy their ad hoc tickets more than a month before the event itself.

NOW LET’S TALK ABOUT

THE BIG BUYS

When the big customer wants to go to the sold out game and the company doesn’t own season tickets, they turn to what is known as the Secondary market, where tickets are re-sold by ticket brokers and other fans for a number of reasons. The secondary market is dominated by StubHub, Ticketmaster’s Ticket Exchange, and a handful of ticket brokers who re-sell tickets based on demand.

The events are so in-demand companies pay an average of $366 per ticket. Though that number sounds high, companies reported a potential ROI of 1998% on each ticket.

Conclusion: Tickets drives real business with high ROI.

STUDY FACTS

The corporate customer study pulls data from over 4,000 companies and 5 million tickets. This sample is the broadest scope of corporate ticket data available from 2012 and includes a range of small companies*All ticket data is anonymous. InviteManager has maintained the integrity of data by adjusting for outliers and understanding the economic differences between each major region with hundreds of tickets to enterprise giants with tens of millions dedicated to entertainment spend annually.*